No products in the basket.

The RCEP is expected to increase Thailand’s trade and investments with its key economic partners in the Asia Pacific. The trade agreement will also help increase the country’s trade with East Asia, most notably, South Korea and Japan.

Thailand is already seeing the benefits of the Regional Comprehensive Economic Partnership (RCEP) trade agreement, half a year after it came into effect. Fruits, vegetables, textiles, vehicles, and vehicle parts have been some of Thailand’s early beneficiaries under RCEP, witnessing spikes in trade in early 2022.

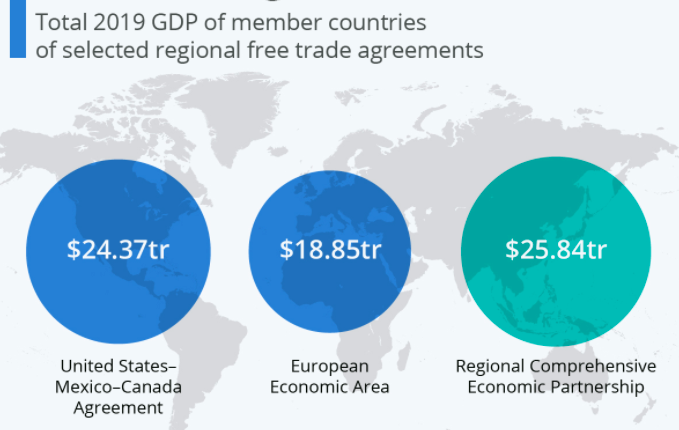

Observers often call RCEP the “world’s largest trade deal”, as the 15 participating countries represent close to 30 percent of the world’s GDP. Thailand was one of the first countries to ratify RCEP, in October 2021, and the deal later came into force on January 1, 2022.

The Thai government hopes that RCEP will contribute to the country’s economic recovery amid the pressures of COVID-19 and high inflation while helping the country become a more sophisticated trading partner in the longer term. Here, we look at the impacts of RCEP on Thailand’s economy.

What tariff cuts are offered to Thailand under the RCEP?

Thailand’s Ministry of Commerce estimates that 39,366 items will see tariff reductions under RCEP, 29,891 of which will be covered in the deal’s first phase. In comparison, South Korea has 11,104 items, Japan 8,216, China 7,491, New Zealand 6,866, and Australia 5,689. Additionally, RCEP establishes frameworks for cooperation on trade and investment, including in connection to intellectual property and e-commerce.

As such, the RCEP stands to increase trade and investment with many of Thailand’s key economic partners in the Asia Pacific. Overall, RCEP will cut 91 percent of tariffs among participating countries – many of these tariff cuts will occur immediately, in the agreement’s first phase, while others will be gradually introduced over a span of up to 20 years.

Does Thailand need to be in the RCEP?

RCEP will introduce additional tariff cuts and a standardized trade framework across the region that will further stimulate trade and investment. Thailand’s trade with RCEP countries from 2016 to 2019 was worth US$269 billion per year, or about 60 percent of the country’s total trade. RCEP will likely increase both total trade and the proportion of Thai trade occurring within RCEP countries.

This will be aided by RCEP’s harmonized rule of origin provisions, which allow RCEP-sourced inputs to be counted as local when manufacturing finished products. These provisions will encourage sourcing from within RCEP countries, allowing businesses to claim greater incentives and preferential tariffs while lowering supply chain management and compliance costs.

As part of ASEAN, Thailand was already party to the ASEAN Free Trade Area and free trade agreements with each Australia, China, Japan, New Zealand, and South Korea. Because of these preexisting agreements, the impact of RCEP on Thailand is likely to be less dramatic than when viewed in isolation. For example, about 85-90 percent of agricultural products imported from Australia, China, Japan, New Zealand, and South Korea were already tariff-free in Thailand.

Nevertheless, the tariff cuts under RCEP will create a favorable environment for a variety of Thai products in the Asia Pacific. Thailand currently has trade surpluses with most ASEAN countries, as well as Australia and New Zealand, but trade deficits with China, Japan, and South Korea.

In 2022, among RCEP countries, Thailand’s largest trade surplus was with Vietnam (US$7.2 billion) and its biggest trade deficit was with China (US$26.8 billion). Overall, Thailand had a trade deficit of US$15 billion with RCEP countries in 2022, largely because of China.

How will the RCEP increase Thailand’s market access to East Asia?

Because Thailand already has existing free trade agreements with China, Japan, and South Korea, these countries agreed to offer additional tariff reductions to Thailand in RCEP negotiations. Accordingly, China, Japan, and South Korea are among the countries that will likely increase their imports of Thai products as a result of the deal.

Below are some notable tariff reductions for Thai exports offered by East Asian countries, as reported in the Bangkok Post:

- China: China will open its markets to 653 Thai items, up from 33 items in earlier negotiations. Items include pepper, processed pineapple products, coconut water, TV receivers, styrene, auto parts, and paper. China will cut tariffs on flavored pineapples, pineapple juice, coconut juice, and synthetic rubber from 7.5-15 percent to zero percent within 20 years, and auto parts (including electrical equipment for lighting or signaling and windshield adjusters), and wire and cable for wiring harnesses used in cars from 10 percent to zero percent within 10 years.

- Japan: Japan will cut tariffs on a variety of Thai agricultural and food products. Japan will reduce tariffs on vegetables (such as tomatoes, beans, asparagus, and garlic powder) from 9-17 percent to zero percent within 16 years, frozen pineapple from 23.8 percent to zero percent within 16 years, and roasted coffee from 12 percent to zero percent within 16 years.

- South Korea: South Korea will cut tariffs on a variety of Thai agricultural and food products. South Korea will reduce tariffs on fresh, dried, and frozen fruit from 45 percent to zero percent within 10-15 years, pineapple juice from 50 percent to zero percent within 10 years, and fishery products from 10-35 percent to zero percent within 15 years.

For many participating countries, items excluded from tariff cuts under RCEP are agricultural products and automotive products due to their strategic importance. Yet, because of the commitments from China, Japan, and South Korea, these are some of the industries where Thailand is poised to see the most benefits.

Additionally, the tariff cuts, combined with the agreements on intellectual property and e-commerce, have the potential to stimulate Thailand’s international e-commerce trade within the region. Industries that could benefit from e-commerce include food products, textiles, and electronics. However, Thailand’s e-commerce sector is comparatively underdeveloped compared to many other Asian countries, presenting logistical challenges for businesses selling through such channels.

How will RCEP impact Thailand’s place in regional trade?

While Thailand will see many benefits from increased trade under RCEP, it will also face heightened competition from other participating countries. In particular, Thailand will face challenges competing with China for affordable manufactured products, while tariff cuts on advanced products from Japan and South Korea risk presenting hurdles in Thailand’s attempts to move up the value chain. Accordingly, while Thai exports to China, Japan, and South Korea are set to increase under RCEP, the trade deficit with these countries – especially China – may increase.

Regardless of RCEP’s effects on individual economies, the establishment of a free trade area will allow businesses operating throughout the Asia Pacific to optimize their supply chains and market reach throughout the region. As such, businesses with a presence in Thailand would do well to re-evaluate their operations in light of the changes introduced by RCEP.

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, Munich, and Essen in Germany, Boston, and Salt Lake City in the United States, Milan, Conegliano, and Udine in Italy, in addition to Jakarta, and Batam in Indonesia.

Discover more from Thailand Business News

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.