No products in the basket.

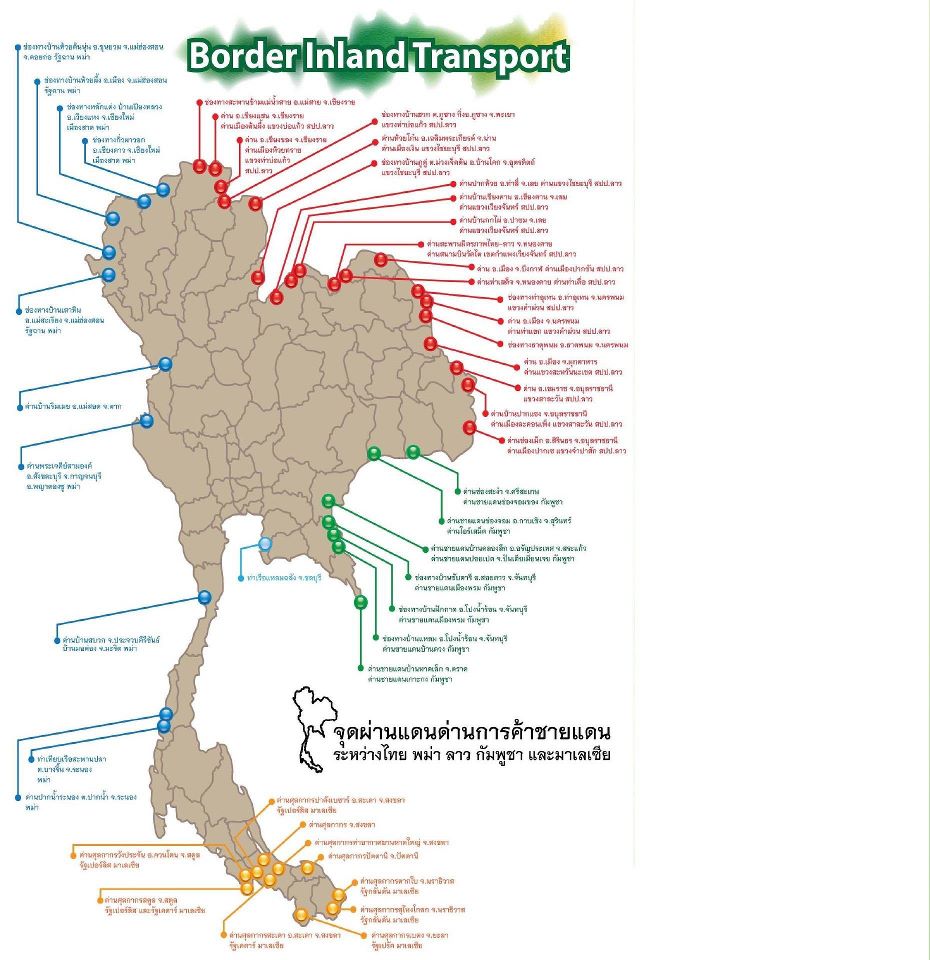

Strategically located at the crossroads of mainland Southeast Asia, the Kingdom of Thailand shares a common land border with four neighboring countries totaling 5,582 kilometers. In fact, there are 30 Thai provinces physically connected with Myanmar, Laos, Cambodia, and Malaysia.

Presently, Thailand is linked to its neighbors through an extensive and functioning network of roads, waterways, and air routes. Yet with the ASEAN Economic Community looming in the distance and the Thai government’s drive to lift the country out of the middle-income trap, improvements need to be made in the field of logistics if the Kingdom aims to achieve future progress and prosperity.

Over the past 20 years, Thailand’s international trade has expanded over 600%. Manufacturing exports, in particular, have increased to where they account for 86% of the country’s total exports as of September 2014. Such growth, aided in part by the Kingdom’s bilateral trade agreements with Japan, South Korea, China, India, New Zealand, and Australia, has led the Thai government to upgrade its logistics infrastructure and expertise.

Currently, foreign companies dominate the logistics industry in Thailand. Its top 10 freight forwarders are Maersk Line, K&N, DHL, UPS, Schenker, Panalpina, Phoenix International, BAX Global, Agility, and UTI.

Totaling US$ 219 billion worth of goods, exports contributed to 58% of Thailand’s GDP in 2013

and the transport sector underpinned this notable performance. The export-dependent nature of the Thai economy, with recent structural changes toward a higher share of value-added manufactured goods and level of global trading, requires a strong and integrated transport and trade facilitation system.

As a result, the government of Thailand is working on improving its trade systems such as the customs. An e-logistics system is currently being introduced, to cut logistics cost, reduce paperwork, optimize routes and flows, and increase the time management proficiency of freight transport companies.

The logistics sector is a huge industry in Thailand.

It contributes about Bt300 billion to the economy annually, accounting for 3.2% of the country’s total GDP and providing employment to some 3.5 million Thais. Furthermore, the Kingdom has been witnessing a downward trend of logistics cost per GDP over the past decade, from a range of 16-18% during 2001-2008 to a range of 14-15% during 2009-2012.

Transportation costs in Thailand remain high due to a limited capacity of competitive alternative modes of transport albeit the efforts of operators to apply IT to lower hauling overheads. In addition, the sector still relies heavily on land transport (accounting for 83% share) despite the elevated price of oil.

According to the 2014 Logistics Performance Index conducted by the World Bank, Thailand ranks 35 in logistics competency among all 160 countries, thereby demonstrating its competitiveness in the region compared to other developing countries.

It must be said that the Thai economy needs to improve the efficiency of its logistics systems, which is revealed by its relatively high costs in relation to its GDP. Having a direct impact on both the industrial structure and spatial distribution of the economy, the costs associated with logistics in Thailand have a direct impact upon the sustainable development of the Thai economy. While the government of Thailand has taken proactive measures to reduce national logistics costs in relation to its GDP, it is now a priority to craft the appropriate logistics policies in order to propel forward the economic development of the Kingdom.

via BOI: Thailand Investment Review.

Discover more from Thailand Business News

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.