No products in the basket.

The Bank of Thailand (BOT) is planning to ease the rules on using the Chinese yuan for trade settlement with China, as part of its efforts to reduce the impact of US dollar volatility on Thai businesses.

The US dollar has been fluctuating significantly in the past year, affecting the global economy and trade. The Thai central bank wants to promote yuan-baht trade settlement as a way to reduce the reliance on the greenback and mitigate the exchange rate risk.

Key Takeaways

- Regulations limiting yuan-baht trade payment are expected to be relaxed to reduce the impact of currency volatility and promote the use of the yuan for trade, investment and tourism activity between China and Thailand.

- The Bank of Thailand has implemented local currency settlement frameworks with Asian and Asean central banks to promote the use of local currencies in bilateral trade settlement and direct investment.

- Thai companies need more currency settlement options to reduce overreliance on any single currency and promote cross-border trade transactions.

Bilateral currency swap arrangement

According to BOT governor Sethaput Suthiwartnarueput, the BOT and the People’s Bank of China (PBOC) have signed a bilateral currency swap arrangement (BSA) in 2020, which allows for the exchange of up to 70 billion yuan or 370 billion baht for a period of five years. The BSA is intended to support trade and investment in local currencies, strengthen bilateral financial cooperation, and boost confidence among the private sector in using local currencies for cross-border operations.

However, the use of yuan-baht settlement remains low, accounting for only 2.26% of Thailand’s total international trade transactions in 2021. The BOT is in talks with the PBOC on how to promote the use of the yuan, and expects to relax some rules on yuan usage for trade, investment, and tourism activity this year.

Yuan’s Cross-Border Settlements on the rise

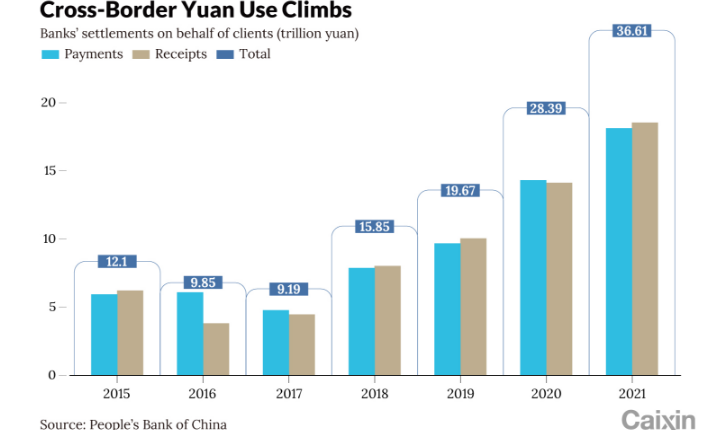

Globally, China’s currency gained traction in 2021, with cross-border yuan settlements growing 29% by value from the previous year, a central bank report shows.

The expanding cross-border use of the yuan suggests that China’s years-long campaign to encourage the use of the currency abroad, notably through its own Cross-Border Interbank Payment System (CIPS), is succeeding.

Cross-border yuan settlements grew to 36.61 trillion yuan ($5.12 trillion) last year, consisting of 18.51 trillion yuan in receipts and 18.1 trillion yuan in payments, according to the People’s Bank of China’s (PBOC)

China is Thailand’s largest trading partner, with a trade value of US$105 billion in 2021, representing 17.9% of Thailand’s total trade value. China is also a major source of tourists for Thailand, with an expected increase in Chinese visitors in the second half of 2023.

The BOT believes that promoting yuan-baht settlement will help mitigate foreign exchange risk amid ongoing US dollar fluctuations, as well as enhance trade and economic ties between Thailand and China.

Why is the dollar volatile?

The US dollar is the world’s reserve currency, meaning it is widely used for international transactions and held by central banks as part of their foreign exchange reserves. The demand and supply of the dollar affect its value relative to other currencies.

According to the Bank for International Settlements (BIS), the US dollar index, which measures the value of the dollar against a basket of six major currencies, rose by 8.8% from March 9 to March 20, 2020, as investors sought safe-haven assets amid the market turmoil. However, the index then fell by 12.5% from March 20, 2020, to January 6, 2021, as the US Federal Reserve cut interest rates to near zero and expanded its asset purchase program, weakening the dollar’s appeal.

The index rebounded by 4.3% from January 6 to March 31, 2021, as the US economy showed signs of recovery and inflation expectations rose, boosting the prospects of monetary policy tightening. However, the index then declined by 3.7% from March 31 to May 24, 2021, as the Fed maintained its dovish stance and other economies also improved their growth outlooks.

How does the dollar volatility affect Thailand?

Thailand is an open economy that relies heavily on exports and tourism as key drivers of growth. The volatility of the dollar can have significant impacts on Thailand’s trade competitiveness, foreign exchange reserves, external debt, and inflation.

The volatility of the dollar can also affect Thailand’s inflation rate through two channels: import prices and domestic demand. A stronger baht can lower import prices and reduce inflationary pressures from imported goods and services. However, a weaker baht can increase import prices and raise inflationary pressures from imported goods and services.

A stronger baht can also dampen domestic demand by reducing export income and tourism receipts in terms of baht. However, a weaker baht can boost domestic demand by increasing export income and tourism receipts in terms of baht.

What are some efforts to ease dollar volatility?

The benefits of using yuan-baht trade settlement include reducing exchange rate risk exposure, lowering transaction costs, enhancing trade efficiency and competitiveness, and strengthening financial cooperation between Thailand and China.

The challenges of using yuan-baht trade settlement include limited availability and accessibility of yuan liquidity in Thailand’s financial system; lack of awareness and understanding among Thai businesses about yuan-baht trade settlement; regulatory barriers and operational issues related to cross-border payments; and uncertainty about China’s exchange rate policy and capital controls.

To overcome these challenges, the BOT has been implementing various measures such as establishing a bilateral currency swap agreement with China; providing yuan liquidity facilities for banks; developing yuan payment infrastructure; conducting public education campaigns; facilitating regulatory coordination; and supporting market development.

Discover more from Thailand Business News

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.