No products in the basket.

Cryptocurrencies and Digital Asset Laws in Thailand

The Thai government typically supports cryptocurrencies based on its present rules since they diversify the ways in which Thai business operators can raise investment capital.

In recent years, cryptocurrencies have gained significant popularity and attention worldwide, with an increasing number of people investing in digital assets like Bitcoin, Ethereum, and others. As with any emerging technology or industry, governments have been struggling to keep up with the regulatory framework to ensure that digital assets are not being used for illegal activities such as money laundering, terrorism financing, and tax evasion. Thailand is one of the countries that have been proactive in regulating cryptocurrencies.

Thailand has emerged as a crypto-friendly nation, ranking 10th globally in terms of adoption. The government, while wary of the risks, supports cryptocurrency due to its potential for stimulating economic growth and diversifying investment opportunities.

Key Highlights:

- Regulation: Thailand was one of the first countries to regulate cryptocurrency, issuing licenses for digital asset exchanges and brokers. The Securities and Exchange Commission (SEC) plays a crucial role in monitoring businesses in the digital asset sector and ensuring investor protection.

- Taxes: A significant change occurred in January 2024 when the Finance Ministry removed the 7% VAT on earnings from cryptocurrency and digital asset trading. The government aims to make Thailand a digital asset trading hub.

- Market Share: As of January 15, 2024, Tether held the largest market share of the most traded cryptocurrencies in Thailand, accounting for approximately 40.3 percent of the market.

- Government Initiatives: Thailand has been involved in CBDC pilots, including Project Inthanon, which aims to develop a retail CBDC. The government’s support for cryptocurrency is further evident in the digital wallet scheme proposed by the Prime Minister, Srettha Thavisin.

- Financial Institutions: Banks and other financial institutions in Thailand are increasingly showing interest in the crypto sector, contributing to its development.

Challenges:

- Crypto Payment Ban: In April 2022, the Thai SEC banned crypto payments for goods and services, citing concerns about financial stability.

- Regulatory Concerns: While supportive, the government remains cautious about the sector’s impact on the nation’s financial system.

Overall, Thailand’s crypto landscape demonstrates a balance between encouraging innovation and safeguarding investors. The country’s regulatory framework, tax incentives, and growing adoption by financial institutions position it as a potentially key jurisdiction for offshore digital asset investors.

Most Relevant Contexts:

- Cryptocurrencies in Thailand – statistics & facts | Statista

- Three Reasons Why Crypto Is Growing in Thailand

- Blockchain & Cryptocurrency Laws & Regulations | Thailand

- Thailand: market share of cryptocurrencies 2024 | Statista

- Cryptocurrencies and digital tokens taxation in Thailand

Cryptocurrencies in Thailand

Thailand’s relationship with cryptocurrencies has been a dynamic and evolving journey. As of 2024, the Thai population has shown a remarkable openness to digital currencies, with a significant portion of the populace engaging in cryptocurrency transactions. The country has been at the forefront of crypto adoption, with its government taking progressive steps to regulate and integrate cryptocurrencies into the national economy.

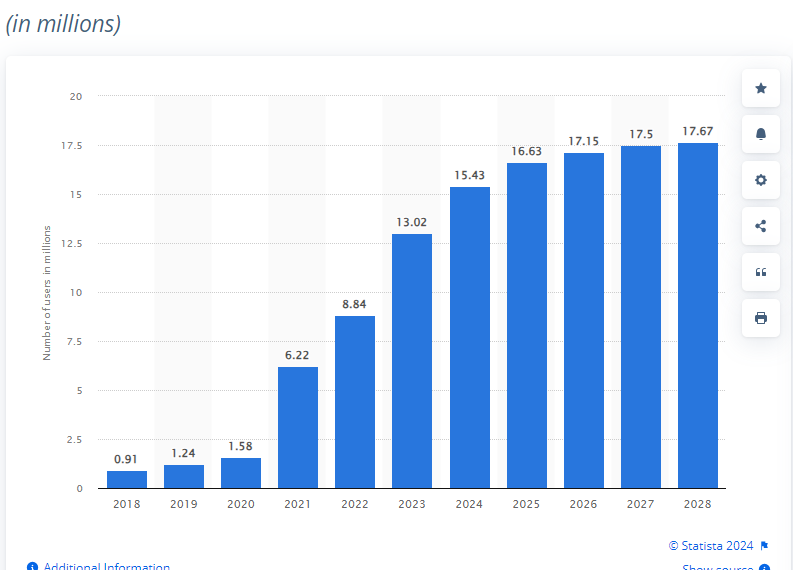

In recent years, Thailand has seen a surge in cryptocurrency usage, especially during the bull run of the COVID-19 pandemic in 2021, when Bitcoin reached an all-time high value. This period marked a significant milestone for the country, leading the world in the number of NFT users. The Thai government’s somewhat supportive stance on cryptocurrencies, recognizing their potential for national development, has played a crucial role in this growth.

The Securities and Exchange Commission (SEC) of Thailand has been instrumental in shaping the crypto landscape with crypto-friendly regulations. In 2024, the SEC made a groundbreaking move by removing investment limits for retail investors in digital tokens backed by real estate or infrastructure. This regulatory update is expected to broaden the market and support the development of the nation’s digital asset sector.

Despite the enthusiasm, cryptocurrencies are not recognized as legal tender in Thailand. Instead, they are classified as “digital assets” under the Royal Decree on Digital Asset Business, effective since May 14, 2018. This classification allows for the issuance, trading, and exchange of cryptocurrencies by licensed digital asset business operators.

The Thai SEC’s approach to crypto regulation has been cautious yet innovative, ensuring that expansion plans of digital asset businesses align with regulatory standards while fostering a secure environment for investors. With the introduction of Binance Thailand and its collaboration with local banks, the country is poised to strengthen its position in the global crypto market.

What are the most popular cryptocurrencies in Thailand?

The landscape of cryptocurrencies in Thailand is diverse and vibrant, reflecting the country’s progressive stance on digital assets. As of 2024, the most popular cryptocurrencies in Thailand, based on market share and public interest, include Tether, which holds a significant portion of the market at around 40.3%, followed by other prominent names such as Optimism and Perpetual Protocol.

Bitcoin, the pioneer of cryptocurrencies, continues to be one of the most traded and viewed digital currencies in Thailand, alongside Ethereum and Tether. The popularity of these cryptocurrencies is indicative of the Thai population’s growing interest and confidence in the potential of digital assets.

The Thai market has also shown interest in a variety of other cryptocurrencies, with platforms like CoinMarketCap listing the most viewed cryptocurrencies in the country, providing insights into the dynamic preferences of Thai crypto enthusiasts.

This enthusiasm for a range of cryptocurrencies suggests a healthy and diverse crypto ecosystem in Thailand, which is supported by the government’s regulatory framework aimed at fostering innovation while protecting investors. As the digital asset landscape evolves, Thailand’s crypto market is likely to continue its growth trajectory, contributing to the country’s economic development and technological advancement.

Rules and regulations

In Thailand, cryptocurrency regulation is primarily overseen by the Securities and Exchange Commission (SEC) under the Digital Asset Businesses Decree. Here are the key aspects of the regulatory framework:

- Licensing: Cryptocurrency exchanges, brokers, and dealers must obtain licenses from the SEC to operate legally.

- ICO Regulations: Initial Coin Offerings (ICOs) are regulated, requiring issuers to register with the SEC and provide detailed information about the project.

- Consumer Protection: The regulations aim to protect investors by requiring transparency and disclosures from digital asset businesses.

- Anti-Money Laundering (AML): Cryptocurrency businesses must comply with AML laws, including customer verification processes.

- Taxation: Gains from cryptocurrency transactions are subject to capital gains tax, and businesses must adhere to VAT regulations.

- Public Awareness: The SEC actively promotes awareness and education about the risks associated with investing in cryptocurrencies.

These regulations aim to foster a secure and transparent environment for cryptocurrency trading while protecting investors.

In 2018, the Thai government enacted the Digital Asset Business Emergency Decree, which regulates digital asset transactions and related activities in the country. The decree covers cryptocurrencies, digital tokens, and other digital assets, and it applies to individuals, businesses, and exchanges operating within Thailand.

The decree classifies digital assets into three categories: cryptocurrencies, digital tokens, and other digital assets. Cryptocurrencies are defined as digital assets used as a medium of exchange, while digital tokens are digital assets used for investments, voting rights, or other purposes. Other digital assets are digital assets that do not fall into the categories of cryptocurrencies or digital tokens.

Under the Digital Asset Business Emergency Decree, all entities engaging in digital asset activities must obtain a license from the Thai Securities and Exchange Commission (SEC) before conducting any business. The license is mandatory for businesses involved in the following activities:

- Digital asset trading

- Digital asset brokerage

- Digital asset dealing

- Digital asset fund management

- Digital asset exchange operation

- Other activities related to digital assets as determined by the SEC.

In addition to the licensing requirement, businesses dealing with digital assets must comply with strict rules and regulations. These include ensuring that customer information is properly verified, that transactions are conducted in compliance with anti-money laundering and counter-terrorism financing laws, and that proper security measures are in place to protect customer assets. Failure to comply with these regulations can result in severe penalties, including revocation of the license, fines, and even imprisonment.

The Thai government has also been working to create a regulatory framework for cryptocurrency exchanges. In 2019, the Ministry of Finance granted licenses to four cryptocurrency exchanges, making Thailand one of the few countries in the world to have a regulated cryptocurrency exchange market. The licensed exchanges are required to comply with strict anti-money laundering and know-your-customer regulations, which helps to prevent fraud and protect investors.

In addition to the SEC’s regulations, the BOT has also issued guidelines for banks and other financial institutions regarding the use of cryptocurrencies in payment systems. These guidelines require financial institutions to conduct customer due diligence, monitor transactions for suspicious activity, and report any suspicious transactions to the authorities.

Thailand has also established a regulatory sandbox for digital assets, which provides a platform for innovative financial technology companies to test their products and services. This sandbox allows companies to experiment with new business models and technologies in a controlled environment, with regulatory oversight and guidance.

Another factor contributing to Thailand’s cryptocurrency boom is the country’s thriving tech startup scene. Many young entrepreneurs in Thailand are working on blockchain-based projects, which has helped to create a supportive community for digital currencies. The government has been investing in initiatives to support tech startups, which has helped to attract talent and investment to the sector.

In conclusion, Thailand’s regulatory framework for digital assets is relatively advanced compared to many other countries. The Digital Asset Business Emergency Decree provides a clear framework for businesses dealing with digital assets, and the regulatory sandbox provides a platform for innovation and experimentation. While the regulations are strict, they are necessary

You must be logged in to post a comment.