No products in the basket.

The strengthening US dollar since mid-April has prompted a sharp currency depreciation and/ or a significant decline in foreign exchange reserves in a number of emerging and frontier market countries.

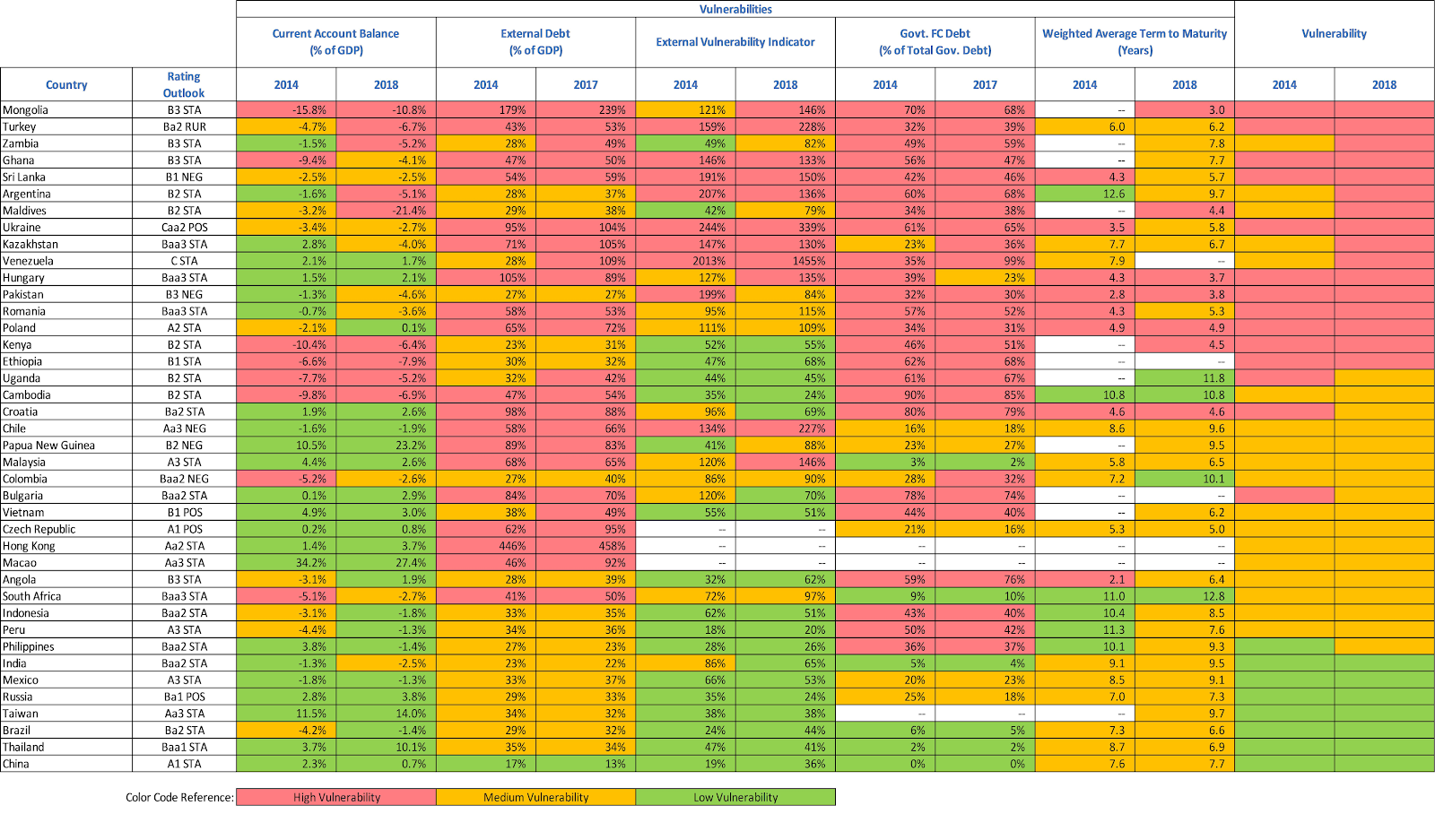

Moody’s has published a Sector In-Depth titled “Sovereigns – Global: US dollar appreciation raises credit risk for sovereigns with large external funding needs” rating Thailand in the lowest vulnerability tier to a stronger dollar.

To the extent that these currency fluctuations reflect capital outflows or significantly lower external inflows, they are credit negative for sovereigns with large external funding needs. In this report, we analyze the vulnerability of a group of emerging markets to a strengthening US dollar and where relevant, identify mitigating factors.

Moody’s considers the sovereigns’ current vulnerability, changes in vulnerability in the last four years, and evidence of exposure to financial market shocks.

Countries with large current account deficits, high external debt repayments and substantial foreign-currency government debt are most exposed.

Moody’s ratings take into account sovereigns’ relative vulnerability to changes in external financing conditions.

Thailand’s debt to GDP ration at 34% is considered as a medium vulnerability rating by Moody’s, but the very low percentage (2%) of foreign currency is credit positive and rated as “low vulnerability”.

In comparison Indonesia (42%) and Cambodia (85%) have a much higher exposure of their debt to FC fluctuations.

Countries with large current account deficits, high external debt repayments and substantial foreign-currency government debt are most exposed.

The US dollar has appreciated by nearly 6% in trade-weighted terms since mid-April, while capital flows to emerging markets have slowed.

Although we expect only a moderate further appreciation of the US dollar, the US Federal Reserve’s balance sheet shrinking may have further implications for external financing conditions in emerging markets.

In this report, we analyze the vulnerability of a group of emerging markets to a strengthening US dollar and tightening external financing conditions in general.

Economies rely on capital inflows to meet import payments and repay external debt. When risk appetite weakens, investors tend to shift their portfolios away from the economies most reliant on such capital inflows, in particular those with low reserve buffers. In turn, lower capital inflows erode foreign exchange reserves, potentially starting a negative feedback loop.

Discover more from Thailand Business News

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.