No products in the basket.

ASEAN IPO market has shown growth and challenges, with Indonesia, Thailand, and Malaysia leading in funds raised. Outlook is cautiously optimistic, with opportunities in key sectors for future activity. Challenges include falling investor sentiment and market illiquidity.

Table of Contents

Executive Summary

The Initial Public Offering (IPO) market in the ASEAN region has experienced significant transformations over the past five years, reflecting broader global economic trends and regional political dynamics. Between 2018 and 2023, the ASEAN IPO market experienced periods of robust growth combined with significant downturns, reflecting the volatility seen in global financial markets.

Key Takeaways

- ASEAN IPO market experienced fluctuations but showed strength, with Indonesia, Thailand, and Malaysia emerging as the most active markets.

- Challenges include falling investor sentiment, market illiquidity, and uncertain geopolitical conditions.

- Strong IPO pipeline in consumer goods, energy, and EV sectors indicates potential for future growth in the ASEAN region.

When compared with global markets such as the US, UK, and Hong Kong, the ASEAN IPO market presents a unique set of opportunities and challenges.

The year 2023 was a year of uncertainty due to global supply chain disruptions, rising inflation, and geopolitical tensions resulting in investors to exercise caution. These factors contributed to increased market volatility, causing some companies to delay their IPO plans.

The IPO markets in the ASEAN countries have shown varying levels of activity over the past 5 years, with Indonesia, Thailand, and Malaysia continue to dominate the region in terms of funds raised. Singapore continues to be a hub for start-ups looking for favourable listing conditions overseas, while Vietnam and the Philippines are taking steps to overcome their recent downturns.

As the region continues to navigate economic uncertainties and geopolitical challenges, the overall outlook remains cautiously optimistic, however, challenges like falling investor sentiment and market illiquidity need to be addressed to sustain and enhance the market’s attractiveness.

ASEAN IPO Market Performance – An Overview

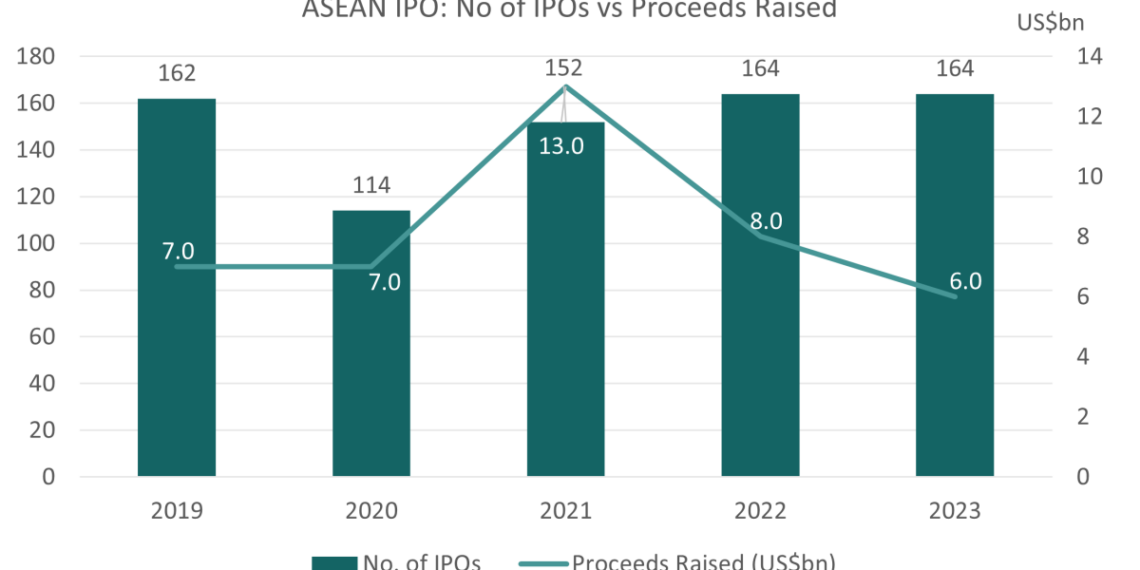

The capital markets across the ASEAN region produced nearly 756 listings, raising approximately $41.0bn. Indonesia and Thailand accounted for most of these listings.

Source: S&P Capital IQ, Deloitte, Statista.com

2020: Pandemic Impacts IPO Market

The onset of the COVID-19 pandemic in early 2020 brought unprecedented challenges to the global economy, and the ASEAN IPO market was no exception. The initial months of the pandemic saw a sharp decline in IPO activity due to uncertainty and volatility in the markets. However, the second half of 2020 witnessed a remarkable recovery. Governments across the region implemented various stimulus measures, and there was a significant pivot towards sectors such as technology and healthcare, which thrived amid the pandemic conditions. Some of the notable IPOs in 2020 were Central Retail Corporation Public Company, SCG Packaging and Converge Information and Communications.

2021 and 2022: Significant Recovery in IPO Activity

The years 2021 and 2022 marked a period of recovery and resilience for the ASEAN IPO market. Despite the effects of the pandemic, there had been significant activity related to IPOs. The market saw a flood of listings during these two years, particularly in the technology and renewable energy sectors such as the listings of Bukalapak in Indonesia and PTT Oil and Retail Business in Thailand. The IPO market in the region benefited from global trend towards digital transformation and sustainability, attracting both regional and international investors.

2023: A Year of Uncertainty

The global supply chain disruptions, rising inflation, and geopolitical tensions had a diminishing effect on investor sentiment towards the end of 2022. These factors contributed to increased market volatility, causing some companies to delay their IPO plans.

Macroeconomic factors such as high interest rates, geopolitical uncertainties, and a shift in investor preferences towards proven profitability and sustainable cash flows as compared to previously popular high-growth, high-risk stocks posed significant challenges for IPO activity in 2023.

The number of IPOs remained the same during 2023 and 2022 at 164 listings, however, the total funds raised from these listings had declined significantly from $8bn in 2022 to $6bn in 2023. Similarly, there has been a drop in the market capitalisation of these listings.

Source: S&P Capital IQ, Deloitte, Statista.com

IPO Market Shifting Towards Consumer Discretionary and Energy & Resource Sectors

In line with global trends, the IPO market in the ASEAN region has been shifting towards energy & resources and consumer discretionary sectors. Historically, real estate, media and technology sectors dominated the IPO market in the region.

At the same time, as the economies in the ASEAN region become high-growth nations with higher per-capita income, increased urbanisation and growing middle-class population, consumer discretionary sector secured the top spot in 2023 with around 55 IPOs.

As countries across the globe strive to meet climate objectives, there has been an increase in the number of energy companies seeking for public listing such as renewable energies (including solar, thermal and wind power) and electric vehicles (EVs) as they look for capital market financing to fund their new projects.

Source: S&P Capital IQ, Deloitte, Statista.com

A Large No. of Companies Listing on the Secondary Board

Secondary board listings have shown a dynamic trend in the ASEAN region from 2018 to 2023. According to statistics, the no. of secondary board listings has consistently outperformed the no. of listings on the main board, which suggests that secondary board listings has become a strong preference among small and medium enterprises (SMEs) for public listings.

During the last two years, around 95% of the companies that went for public listing had market capitalisation of less than $500m, falling under the category of small enterprises.

Between 2018 to 2023, listings on the secondary board have increased from 74 in 2018 to 121 in 2023. This highlights that secondary boards are more appealing for companies seeking to leverage the advantage of being publicly listed, such as easier access to capital and enhanced visibility.

Secondary boards, such as Singapore’s Catalist and Malaysia’s ACE (Alternative Capital Exchange) Market, provide a more accessible entry point for companies that do not yet meet the stringent requirements of the main boards. In Singapore, the Catalist board saw 6 IPOs raising a total of US$35m in 2023, accounting for all of Singapore’s IPOs during that year (on top of these six primary listings, there were two secondary listings on the Main Board in Singapore in 2023).

Source: S&P Capital IQ, Deloitte, Stock Exchange Disclosures, Statista.com

Top ASEAN IPO Performers in 2023

The top 10 IPOs in the ASEAN region in 2023 raised $3.4bn with a market capitalisation of $31.8bn, this accounted for 60% and 76% of total proceeds raised and total IPO market capitalisation respectively during the year. The first six spots were taken by listings in the Indonesian Stock Exchange, with PT Amman Mineral Internasional Tbk ranking the top IPO of the year raising IDR 10.7Tn. Five of the top 10 IPOs were related to Energy and mining industries.

| IPO Date | Target/Issuer | Country | Total Transaction Value (US$m) | Total Transaction Value in Local Currency | IPO Market Cap (US$m) | IPO Market Cap in Local Currency | Industry |

| 07/05/2023 | PT Amman Mineral Internasional Tbk (IDX:AMMN) | Indonesia | 711.67 | IDR10.73trn | 7,910.7 | IDR121.89trn | Copper |

| 04/12/2023 | PT Trimegah Bangun Persada Tbk (IDX:NCKL) | Indonesia | 668.38 | IDR9.99trn | 5,047.9 | IDR78.87trn | Diversified Metals and Mining |

| 04/18/2023 | PT Merdeka Battery Materials Tbk. (IDX:MBMA) | Indonesia | 650.14 | IDR9.18trn | 5,427.3 | IDR85.86trn | Diversified Metals and Mining |

| 02/24/2023 | PT Pertamina Geothermal Energy Tbk (IDX:PGEO) | Indonesia | 596.08 | IDR9.06trn | 2,483.8 | IDR36.22trn | Renewable Electricity |

| 10/09/2023 | PT Barito Renewables Energy Tbk (IDX:BREN) | Indonesia | 200.42 | IDR3.13trn | 6,689.3 | IDR104.35trn | Renewable Electricity |

| 08/02/2023 | PT Nusantara Sejahtera Raya Tbk (IDX:CNMA) | Indonesia | 149.11 | IDR2.25trn | 1,666.9 | IDR22.50trn | Movies and Entertainment |

| 05/19/2023 | DXN Holdings Bhd.(KLSE:DXN) | Malaysia | 146.61 | MYR709m | 797.6 | MYR3,789m | Personal Care Products |

| 12/20/2023 | SCG Decor Public Company Limited (SET:SCGD) | Thailand | 145.20 | THB5.05bn | 544.5 | THB18.98bn | Building Products |

| 05/31/2023 | Radium Development Berhad (KLSE:RADIUM) | Malaysia | 95.63 | MYR434m | 381.5 | MYR1,734m | Real Estate Development |

| 01/25/2023 | Master Style Public Company Limited (SET:MASTER) | Thailand | 91.19 | THB2.3bn | 336.0 | THB8.52bn | Health Care Facilities |

Source: Exchange Filings, S&P Capital IQ

ASEAN IPO Market vs Global IPO Markets

When compared to global IPO markets such as the US, UK, and Hong Kong, the ASEAN IPO market presents a unique set of opportunities and challenges. While the number of IPOs in the ASEAN region is comparatively lower compared to these developed markets, the growth rates and market capitalization of successful IPOs in ASEAN often surpass those in more mature markets. Despite global uncertainties, ASEAN market continues to demonstrate strength with a steady stream of high-profile listings.

The US IPO Market

The IPO market in the US experienced significant fluctuations from 2018 to 2023, marked by periods of rapid growth, historic highs, and substantial declines.

A notable trend during this period was the boom and subsequent bust of SPACs (Special Purpose Acquisition Companies). In 2020 and 2021, SPAC activity reached record levels with 613 SPAC IPOs raising around $145bn in 2021. However, the SPAC market declined sharply during the last two years due to increased investor scepticism and regulatory scrutiny.

Source: S&P Capital IQ, Deloitte, Renaissance Capital

On a sector basis, Healthcare and Technology continued to dominate IPO activity throughout this period. These sectors attracted high investor interest due to their growth potential and innovations. Market volatility was another key factor, with the IPO market responding sensitively to macroeconomic conditions such as interest rate changes, geopolitical events, and economic cycles, leading to significant year-to-year variations.

Direct listings emerged as an alternative to traditional IPOs, with companies like Spotify, Palantir, and Roblox opting for this method. This trend reflects a shift towards more flexible ways of going public, allowing companies to bypass some of the traditional IPO processes.

IPO performance varied significantly. While initial returns were often strong, aftermarket performance was inconsistent, with some years seeing substantial declines in average returns. This variability underscores the importance of market conditions and investor sentiment in determining the success of IPOs.

The UK IPO Market

The UK IPO market experienced substantial fluctuations between 2018 to 2023, reflecting the broader economic and geopolitical landscape. The market saw periods of strong activity, record-breaking years, and significant downturns, influenced by factors such as Brexit, the COVID-19 pandemic, and global economic uncertainties. Despite all of this, the London Stock Exchange continues to retain its position as Europe’s most active IPO market.

Source: London Stock Exchange Filings, Deloitte, EY, Statista

In 2021, the UK market recorded a historic year with 119 IPOs raising approximately GBP14.6bn. Technology, financial services, and consumer sectors led the market, with Deliveroo, Darktrace, and Dr. Martens among the largest IPOs. The market performed exceptionally well, with high investor interest and strong post-IPO returns, driven by favourable market conditions and investor sentiment.

However, the market experienced a significant decline in 2022 with 45 IPOs raising around GBP1.6bn, and rising inflation, interest rates, and global market volatility contributed to the decline.

This further declined in 2023 with just 23 IPOs raising around GBP1.0bn. The financial services and technology sectors saw some activity, with CAB Payments Holdings plc and Admiral Acquisition being significant IPOs during the year.

The Hong Kong IPO Market

The Hong Kong IPO market, a significant global financial hub, witnessed substantial fluctuations from 2018 to 2023. In 2018, the Hong Kong IPO market saw strong performance with 205 IPOs raising $36.5bn. The technology and financial sectors were predominant, with high-profile IPOs such as Xiaomi and Meituan-Dianping. The market performed well with strong first-day returns and significant investor interest.

The market experienced a record-breaking year in 2019 with 162 IPOs raising $40.3bn, with technology sector leading the market along with increased activity in the healthcare sector. Notable IPOs included Alibaba’s secondary listing in Hong Kong, which raised $12.9bn. Despite global trade tensions, the Hong Kong IPO market remained resilient, driven by significant capital inflows and investor confidence.

Source: EY, HKEX filings

The Hong Kong IPO market remained resilient amidst the pandemic in 2020, with 144 IPOs raising $51.2bn. The healthcare and technology sectors dominated, capitalizing on the global shift towards digital health-related services. JD.com and NetEase had successful secondary listings in the market.

The market performed exceptionally well in 2021 with 97 IPOs, driven by high investor demand and favourable market conditions. The technology and consumer sectors saw significant activity, with Kuaishou Technology raising $5.4bn.

The market experienced a downturn in 2022 with just 75 IPOs raising around $12.7bn, driven by geopolitical tensions, regulatory crackdown in China, and global market volatility. Investors remained cautious, leading to lower IPO activity and reduced valuations.

The year 2023 marked another significant decrease for the Hong Kong IPO market, with 63 IPOs raising $5.6bn. The largest IPO was ZJLD Group which raised US$ 677m.

Key IPO Markets in ASEAN

The IPO markets in the ASEAN region have shown varying levels of activity over the past 5 years, with key markets such as Indonesia, Thailand, and Malaysia leading in terms of funds raised. Other markets like Singapore, Vietnam, and the Philippines have also shown significant activity, with unique trends and challenges influencing their performances.

Indonesia

Indonesia has dominated the IPO market in the ASEAN region and has demonstrated resilience and growth during the last few years. Beginning from December 2021, tech companies in the country are allowed to issue shares with multiple voting rights easing the requirements for listing.

Source: S&P Capital IQ, Deloitte, Exchange Filings

Shifting Towards Energy & Resource Sector

Indonesia saw a significant increase in IPO activity in 2023 with 79 IPOs raising IDR 54.14Tn, a 66% year-on-year increase in funds raised. The year marked extraordinary growth driven by regulatory reforms aimed at accelerating IPO process. Key sectors driving this growth included energy and resources, especially copper and nickel mining, which are crucial for the electric vehicle (EV) supply chain. Basic Materials sector dominated the IPO market in 2023 accounting for 55.49% of the total funds raised during the year.

Major IPOs such as PT Amman Mineral Internasional Tbk and PT Merdeka Battery Materials Tbk emphasized strong investor interest in the country’s natural resources as well as increasing demand for sustainability related stocks.

The Indonesian IPO market was previously dominated by the tech and telecommunication industry and notable IPOs in these two sectors include PT Dayamitra Telekomunikasi Tbk and PT Bukalapak.com (the first tech unicorn of the country) in 2021 which raised US$1.4bn and US$1.5bn respectively. In 2022, GoTo (merger of Gojek and Tokopedia) made a strong debut at the Indonesian Stock Exchange raising $1.3bn.

Increased Listings on Acceleration Board

The Development Board of the market continues to account for most no. of listings (around 60% in 2023), however, given there were blockbuster IPOs (large sized deals) on the Main Board, the latter dominates in terms of funds raised (around 70% of funds raised in 2023).

Source: S&P Capital IQ, Deloitte, Exchange Filings

The Indonesian Stock Exchange also established The Acceleration Board in 2019 to offer SMEs to raise funds via IPO, and there has been strong increase in the no. of listings on the Acceleration Board in 2023 with 17 IPOs (IDR 818.66Bn raised) vs 10 (IDR 675.81Bn raised) in 2022. This suggests that there will be an increase in the no. of listings going forward as it offers opportunity for more companies to seek public listing.

Thailand

Thailand has maintained a steady IPO market over the last few years, with a peak in the number of IPOs in 2022. Despite the global pandemic in 2020, the Thai IPO market remained active with 26 new listings which raised US$4.7bn, demonstrating the resilience of its capital markets. The country’s largest IPO, the Central Retail Corporation Public Company Limited raised US$2.3bn in 2020 amidst the pandemic.

Source: S&P Capital IQ, Deloitte, Exchange Filings

Thailand’s IPO market showed resilience despite challenges in 2023, with 40 IPOs raising $1.3bn, a significant decline compared to the previous years due to global economic challenges and domestic political uncertainties. This led to several companies to postpone their listing plans. Key sectors such as consumer goods and industrial products continue to attract investor interest.

Malaysia

From 2018 to 2023, Malaysia’s IPO market showed consistent activity, with a notable increase in the number of IPOs in 2022 with 35 IPOs. The country managed to sustain its IPO activities even during challenging economic times, reflecting its resilient capital market infrastructure.

Source: Bursa Malaysia Filings

Malaysia’s IPO market showed strong activity in 2023 with 32 IPOs raising $790m, while market capitalization of these IPOs saw an 18% increase to $3.0bn. Significant IPOs included DXN Holdings Berhad, Radium Development Berhad and Nationgate Holdings Berhad underlining the strong performance of the consumer and industrial products sectors.

The ACE Market, which caters to high-growth small and medium enterprises continue to dominate the listings (75% of total IPOs in 2023), indicating strong activity among smaller companies.

Source: S&P Capital IQ, Deloitte, Exchange Filings

Singapore

Singapore’s IPO market is unique in its trend of local start-ups exploring overseas listings. In 2023, the Singapore Exchange (SGX) raised approximately $35m from six IPO deals on the Catalist board. In addition to the six primary listings in 2023, there were two secondary listings on the Main Board in 2023. These two secondary listings included Comba Telecom Systems Holdings and TSH Resources Berhad and both these companies were listed by introduction.

The movement towards overseas listings is driven by the desire for larger markets and better valuations, influenced by high operational costs and stringent regulatory requirements.

Source: S&P Capital IQ, Deloitte, Exchange Filings

Despite this, Singapore continues to attract high-quality start-ups due to its strong regulatory environment and position as a global financial hub. There were three SPAC listings in 2022 (with the introduction of SPAC listing framework in September 2021) but there hasn’t been any since then. The market does not yet have the appetite for SPAC’s given the challenging market conditions and at the same time, SPAC’s have failed to show strong performance. Financial services, biomedical sciences, and sustainable energy technology sectors have dominated the listings in Singapore.

Vietnam

From 2018 to 2023, Vietnam’s IPO market saw periods of strong performance driven by the government’s privatization efforts and strong economic growth. The IPO market saw 33 listings in 2018 with total proceeds of $4.7bn at a market capitalization of $31.1bn. During the period Joint stock companies such as Vinhomes Joint Stock Company, Dat Xanh Real Estate Services Joint Stock Company, Vietnam Technological and Commercial Joint Stock Bank raised around US$1bn each respectively.

Source: S&P Capital IQ, Deloitte, Exchange Filings

Vietnam’s IPO market faced significant challenges in 2023, with a sharp decline in the number of IPOs and funds raised. There were only 3 IPOs, raising a total of $7m in 2023 compared to 8 IPOs raising $71m in the previous year. The downturn was influenced by global economic conditions, market volatility, and stricter IPO and listing approval processes.

Philippines

Over the period from 2018 to 2023, the Philippines saw varying levels of IPO activity, with a notable increase in 2022 where nine IPOs were completed. The market faced challenges in recent years but remains a key player in the ASEAN region’s IPO landscape.

Source: S&P Capital IQ, Deloitte, PSE Filings

The Philippines’ IPO market experienced a slowdown in 2023, with only three IPOs raising $78m, an 80% decline from the previous year. The slowdown was largely due to economic conditions marked by inflation and rising interest rates, which dampened market sentiment.

The energy and resources sector, especially renewable energy projects, has played a significant role in the IPO market. Notable IPOs included Alternergy Holdings Corporation and Repower Energy Development Corporation, focusing on renewable energy projects to ensure energy security.

Other Markets in the Region

Other markets in the ASEAN region have also shown varied performance. For instance, countries like Myanmar and Cambodia have smaller but growing IPO activities, driven by emerging industries and increasing foreign investments. However, these markets face significant challenges, including regulatory hurdles, political instability, and limited investor base.

Average IPO returns by country

The average IPO returns in the ASEAN region have varied significantly by country from 2018 to 2023. Indonesia consistently showed strong average returns, specially in 2018 and 2020, with average first-day returns ranging from 20% to 50%. Malaysia also demonstrated substantial returns, with notable performances in 2021 (51%) and 2023 (59%). In contrast, countries like the Philippines and Singapore showed more moderate or even negative returns in some years.

| Average of Equity Offering Values – 1 Day Return (%) | ||||||

| Year | Indonesia | Malaysia | Philippines | Singapore | Thailand | Vietnam |

| 2018 | 49% | 29% | -15% | 4% | 8% | -12% |

| 2019 | 50% | 18% | 10% | -1% | 3% | 3% |

| 2020 | 38% | 38% | 11% | 5% | 43% | 0% |

| 2021 | 20% | 51% | 358% | 9% | 50% | -20% |

| 2022 | 17% | 39% | 4% | 70% | 29% | 31% |

| 2023 | 12% | 59% | 7% | -7% | 15% | |

Source: S&P Capital IQ, LSR

| Average of Equity Offering Values – 1 Month Return (%) | ||||||

| Year | Indonesia | Malaysia | Philippines | Singapore | Thailand | Vietnam |

| 2018 | 224% | 30% | -18% | -8% | 1% | -18% |

| 2019 | 188% | 18% | 13% | 0% | -5% | -7% |

| 2020 | 101% | 43% | 47% | 3% | 45% | 47% |

| 2021 | 165% | 61% | 363% | 6% | 54% | -37% |

| 2022 | 47% | 48% | -5% | 16% | 25% | -12% |

| 2023 | 39% | 51% | -2% | -4% | 9% | |

Source: S&P Capital IQ, LSR

| Average of Equity Offering Values – 3 Month Return (%) | ||||||

| Year | Indonesia | Malaysia | Philippines | Singapore | Thailand | Vietnam |

| 2018 | 227% | 38% | -31% | -13% | 3% | -22% |

| 2019 | 243% | 31% | 20% | 2% | -14% | -7% |

| 2020 | 118% | 60% | 64% | 13% | 61% | 44% |

| 2021 | 242% | 55% | 364% | 4% | 58% | -35% |

| 2022 | 27% | 59% | -11% | -8% | 22% | -51% |

| 2023 | 44% | 51% | -1% | 10% | 14% | |

Source: S&P Capital IQ, LSR

ASEAN IPO Market Outlook

The IPO markets in the ASEAN region had a subdued performance during first half of 2024 where the markets raised around $1.4bn as compared to $5.8bn in the same period last year.

Except for Singapore, all other countries saw a decline in proceeds raised where Indonesia had the biggest decline. This is mainly attributable to the absence of blockbuster IPOs during the first half of 2024, where PT Trimegah Bangun Persada Tbk, PT Merdeka Battery Materials and PT Pertamina Geothermal Energy raised raised IDR 9.99Tn, IDR 9.18Tn and IDR 9.06Tn respectively during first half of 2023.

Investors in the region continue to exercise caution given the macroeconomic uncertainty, geopolitical tensions and high interest rates. However, the ASEAN region continues to remain a hotbed for high-growth stocks due to the following:

1. Positive Economic Growth Projected for Key Countries in the Region

The ASEAN region is expected to witness positive economic growth in the coming years, driven by robust domestic demand, increasing foreign investments, and government initiatives to boost economic activities. Countries like Indonesia, Thailand, and Malaysia are projected to see significant economic expansion, which is likely to create a favourable environment for IPOs.

2. Availability of Quality Start-Ups

The availability of quality start-ups in the ASEAN region is another factor contributing to the positive IPO market outlook. Countries like Singapore and Indonesia have thriving start-up ecosystems, supported by government incentives, venture capital investments, and incubators. These start-ups are increasingly looking to the public markets to raise capital for growth and expansion.

3. Positive Capital Market Initiatives

Several positive capital market initiatives are being implemented across the ASEAN region, aimed at enhancing market efficiency and attractiveness. These initiatives include the enhancement of surveillance and good corporate governance, accelerated transfer to the main board, and the reduction of stamp duty on share trading. For example, Indonesia and Malaysia have been actively working on improving their regulatory frameworks to attract more investors and issuers.

4. Strong IPO Pipeline in Key Sectors

The ASEAN region has a strong IPO pipeline in the consumer, energy, and resource sectors, including the Electric Vehicle (EV) supply chain. Indonesia is poised to benefit from its rich natural resources and growing energy sector, with several companies in the mining and EV supply chain sectors preparing for public listings. Thailand and Malaysia also have robust pipelines in the consumer goods and industrial sectors, driven by growing domestic markets and increasing consumer demand.

Indonesia: “Wait-and-See” Approach by Investors

Investors have currently adopted a more cautious stance given the local political environment in the country as a new government is expected to be formed in October 2024. This has caused investors to opt for a “wait-and-see” approach as it is likely to bring new policies or changes to existing policy framework.

Having said that, the Indonesia Stock Exchange remains optimistic about the outlook for the second half of the year and has reported that there are approximately 30 companies in the IPO pipeline, most of them operating in the consumer goods sector. In 2024, Indonesia has listed one lighthouse company, with another set to be listed on the stock exchange this year.

In November 2023, the Hong Kong Stock Exchange (HKEx) added Indonesian Stock Exchange (IDX) as a recognised exchange and this status should allow companies listed on the IDX to apply for a secondary listing in HKEx. Though there aren’t any companies in the pipeline seeking for dual listing on the HKEx, this recognition should make IDX more appealing for international investors and further enhance the efficiency of the country’s capital market.

Thailand: New Policy Framework and Rules to Drive IPOs

There were 17 IPOs during 1H2024 in Thailand (vs 18 in 1H2023), with marking of the IPO of the first commercial bank in a decade (Thai Credit Bank Public Company) which raised $208m at a market capitalisation of $1bn.

As per Thai Stock Exchange Statistics, 13 companies have submitted (under “submitted” status) applications for IPOs of which, seven were REITs. The Stock Exchange of Thailand remains optimistic and expects more companies to go for public listings and surpass the 40 listings in 2023.

The Thai Stock Exchange has brought in a strategy to strengthen investor trust and confidence in the capital market through improving the qualifying criteria (in terms of financial status and operational performance) for listing of companies on both its Main Board and Market for Alternative Investment (MAI). In addition to the above, there will be further rules to improve backdoor listing, shareholder disclosures and free-float requirements. These new regulations will come into full effect in 2025 which we expect to help drive the no. of IPOs in the Thai market.

Malaysia: Government Policies to Drive New Listings

During 1H2024, Malaysia topped the no. of IPOs in the ASEAN region with 21 listings (vs 16 in 1H2023) raising a total of $450m at a market capitalisation of $1.5bn. Though the market was short of mega blockbuster listings during this period, new listings in the ACE Market continued during this period.

The Malaysia Exchange has brought in new measures such as expedited IPO approval process (to approximately 3-months since 01st March 2024), accelerated process to transfer stocks from ACE Board to the Main Board and tax deductions for listings of tech companies.

Malaysian companies have long been benefitting from relatively cheap funding which led to lack of equity fund raising in the nation. However, this is now changing with an increase in the activities around private equity market, suggesting that companies are preparing for big public listings. The market is expecting bigger IPO deals over the next 12-18 months in consumer, telecoms infrastructure and technology sectors. Fast-food retailer QSR Brands and telecommunication tower operator Edotco Group are two of the most awaited IPOs in Malaysia.

Singapore: A Mixed Outlook

The no. of IPOs in the country fell to 1 listing (IPO of Prosper Cap Corporation) during 1H2024 compared to 3 listings in 1H2023, nevertheless, there were five Singapore companies sought for overseas listings in the US during the first half of 2024.

The IPO activity in the country is expected to pick up once interest rates fall and valuations improve, however, there remains scepticism around listings of REITs and SPACs. The Singapore Stock Exchange has remained an attractive hub for REIT listings including listing of overseas REITs, however, REIT listings were absent during the last two years. In a high-interest rate environment, REIT valuations trend lower due to high borrowing costs. REITs use debt to fund their expansion projects and dividend stocks become less appealing when bond yields are high.

As we discussed earlier, there were three SPAC listings in Singapore Exchange in 2022, however, only one of the three companies managed to successfully complete a business acquisition while the other two have failed to acquire operating companies. Due to this, SPAC’s have fallen short of investor expectations, and we do not expect to see SPAC listings in the near-term.

Vietnam: Large Conglomerates to List Their Subsidiaries

Vietnam Exchange saw just one IPO (DNSE Securities) during the first half of 2024 (vs 2 in 1H2023) which raised $37m at a market capitalisation of $173m. However, this single listing has surpassed the 3 listings in 2023 which just raised $7m at a market capitalization of $37m.

Vietnam has delayed the launch of its new trading system provided by the Korean Exchange (KRX) to September 2024 due to regulatory roadblocks. The new system would settle transactions within a day, speeding up the trading process and the country will be upgraded to an Emerging Market from its current status of a Frontier Market which has restricted many funds and family offices from investing in companies listed on the Vietnam Exchange. The new trading system should attract more foreign investors helping companies to raise large funds.

However, the Vietnamese government has planned the adoption of International Financial Reporting Standards (IFRS) from 2025, aiming to boost market confidence and attract more listings

In addition, several large conglomerates in Vietnam have mentioned their plans to list their subsidiaries including Vingroup (listings of Vinpearl and GSM), Bamboo Capital (listing of BCG Energy) and Bach Hoa Xanh (MWG) either by end of 2024 or in 2025.

The Philippines: More Renewable Energy Listings to Come

The Philippines Stock Exchange recorded 2 IPOs during the first half of 2024 raising $200m at a market capitalization of $942m. Both listings were from the Energy & Resource sector suggesting this remains a key IPO sector for the nation. It is also noteworthy that of the three new listings in 2023, two were from the renewable energy sector.

Nexgen Corp, a renewable energy company had its IPO debut in July 2024 on the Philippines Exchange, this we think will encourage other renewable energy firms to seek for public listings. The government of Philippines is actively promoting renewable energy development projects in the nation, which has led to companies seeking for external and capital market funding to expand their operations resulting in a sizeable number of IPOs.

Maynilad Water Services Inc, the water distributor company is slated for an IPO early next year (as part of its mandated IPO by 2027 by the government) and could seek for a potential valuation of $3-4bn (source: Bloomberg) which is one of the most anticipated by investors.

The country’s Stock Exchange is looking to bring in regulatory reforms and marketing campaigns to attract foreign investors into the local market.

Conclusion

The IPO markets in the ASEAN region have demonstrated resilience and growth despite facing numerous challenges. Indonesia, Thailand, and Malaysia have been the most active markets, contributing significantly to the funds raised. Singapore continues to be a hub for start-ups, while Vietnam and the Philippines are taking steps to overcome their recent downturns. As the region continues to navigate economic uncertainties and geopolitical challenges, the overall outlook remains cautiously optimistic, with potential for growth driven by strategic reforms and sector-specific opportunities.

The strong IPO pipeline in key sectors such as consumer goods, Industrials, energy, and the EV supply chain indicates robust future activity.

However, challenges like falling investor sentiment and market illiquidity need to be addressed to sustain and enhance the market’s attractiveness. One of the significant challenges facing the ASEAN IPO market is falling investor sentiment, primarily due to poor share price performance of companies post-listing. Several companies have seen their share prices decline significantly after going public, which has affected investor confidence and led to reduced participation in new IPOs. This trend is particularly shown in markets like Philippines and Vietnam in recent years, where macroeconomic uncertainties and market volatility have impacted post-IPO performance.

Limited trading volumes and a lack of depth in the investor base can lead to higher volatility and reduced attractiveness of these markets for both issuers and investors. Efforts to enhance market liquidity, such as encouraging more retail and institutional participation, are important to address this challenge.

Source : ASEAN IPO Capital Market Outlook

Discover more from Thailand Business News

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.